China’s Mother Roll Toilet Paper China market is projected to experience strong growth in 2025. Domestic brands now dominate with 76% of the FMCG market share. Vinda’s Toilet Paper Roll sales surged, with online sales reaching 25.1%. Increasing demand for raw material for making tissue paper and strong export performance underscore China’s position as a global leader.

Mother Roll Toilet Paper China: Current Market Landscape

Supply and Demand Trends

China’s tissue paper industry keeps growing as demand rises both at home and abroad. In the first half of 2024, export volume of household paper jumped by 31.93%, reaching 653,700 tons. Parent Roll Paper exports saw the biggest increase, up 48.88%. Finished paper products, like toilet paper and facial tissue, still make up most exports at 69.1%. Even though export prices dropped by 19.31% year-on-year, the market stays strong. Imports remain low, with Mother Parent Roll making up 88.2% of them. Domestic production and a wide range of products meet local needs, but the market is clearly export-driven.

Note: The Asia Pacific region, led by China, holds the largest share of the global tissue paper converting machines market. Urbanization and changing lifestyles drive this demand.

Production Capacity and Utilization Rates

Production capacity in China’s tissue paper sector continues to expand. The total installed capacity reached 20.37 million tons in 2023. The compound annual growth rate from 2010 to 2023 stands at 5.3%. Operating rates dipped below 70% in 2021 but recovered to 66% in 2023. New capacity additions slowed after 2022, with 693,000 tons added in the first half of 2024. Production in early 2024 saw a slight drop of 0.6%, totaling 5.75 million tons. Prices have stayed within a narrow range, affected by wood pulp costs and softer demand. The market is maturing, with controlled expansion and shifting consumer preferences.

| Segment | Market Share (2023) | Market Value (USD Million, 2023) | CAGR (2024-2031) |

|---|---|---|---|

| Asia Pacific Region | 48.31% | 712.35 | 5.31% |

| Toilet Roll Converting Lines | 43.24% | 638.09 | 5.69% |

| Automatic Technology | 73.62% | 1086.25 | 5.19% |

| Total Tissue Paper Converting Machines Market | N/A | 1475.46 | 4.81% |

Export Performance and Growth

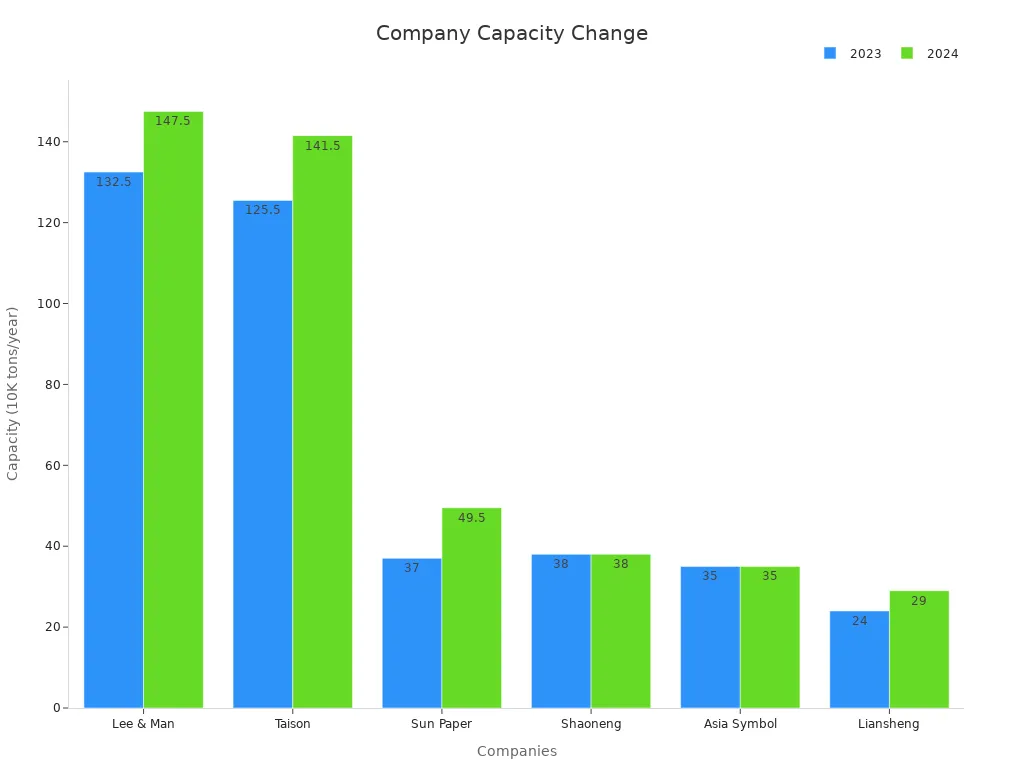

Mother Roll Toilet Paper China continues to shine in global markets. From January to November 2024, export volume hit 1.234 million tons, up 23.49% year-on-year. Export value reached $2.19 billion, a 2.76% increase. Major companies expanded capacity, with 70 new tissue machines starting up in 2024. Thirty companies across 11 provinces added new capacity. Notable players like Lee & Man, Taison, and Sun Paper all boosted their output. Projects like Liansheng’s new pulp line and Golden Hongye’s tissue paper expansion show the industry’s drive for growth.

Production Trends Shaping 2025

Technological Advancements in Manufacturing

Factories in China and around the world are investing in new machines and smarter technology. Many companies now use automated systems to cut, roll, and package tissue paper. These machines help workers do their jobs faster and with fewer mistakes. Some factories use sensors and data to watch every step of production. This helps them spot problems early and keep quality high.

Robots and artificial intelligence (AI) are also making a difference. They can handle heavy rolls, check for defects, and even predict when a machine needs fixing. This means less downtime and more products made each day. Companies that use these new tools can save money and offer better prices to customers.

Note: Automation and smart technology are not just trends—they are becoming the new standard in tissue paper production.

Industry Consolidation and Scale

The tissue paper industry is seeing more big companies join forces or buy smaller ones. This trend is called consolidation. When companies get bigger, they can buy more raw materials at lower prices and run larger factories. This helps them compete in both local and global markets.

Let’s look at some numbers that show how production is changing in different regions:

| Region/Aspect | Statistic/Trend | Implication for 2025 Production Shift |

|---|---|---|

| Europe | Tissue production capacity expected to reach 11.3 million tonnes in 2025 (1% growth from previous year) | Indicates modest growth and recovery in European tissue production capacity |

| Western Europe Consumption | Forecasted growth of 4.1% in 2025, reaching 7.16 million tonnes | Suggests increasing demand supporting production expansion |

| Eastern Europe Consumption | Forecasted growth of 4.4% in 2025, reaching 2.6 million tonnes | Similar demand growth trend as Western Europe |

| Latin America (Brazil) | Integrated tissue production capacity rose from 16.3% in 2016 to 45.4% by end 2024 | Integration boom leading to significantly lower production costs (~20% less) |

| US Tariffs (April 2025) | 33% tariff on Indonesia, 46% on Vietnam, 10% on Turkey; Mexico and Canada exempt | Expected to increase US production costs, shift supply shares to Mexico and Brazil |

| Market Behavior | Consumers opting for smaller, lower-cost tissue products due to inflation | Drives demand for more economical production and integrated supply chains |

| Industry Outlook | Uncertainty among US producers on capacity expansion; importers seeking cheaper sources | Potential reallocation of production and supply chains globally |

Big companies can also invest more in research and development. They can try new ideas and bring new products to market faster. As a result, customers see more choices and better quality.

Sustainability and Eco-Friendly Materials

People care more about the environment than ever before. Companies in the tissue paper industry are listening. Many now use wood from forests that are managed in a sustainable way. This means they plant new trees to replace the ones they cut down. Some factories use recycled paper to make new rolls, which saves trees and energy.

Market research shows that more vendors are choosing eco-friendly materials and greener production methods. They do this because customers want products that are safe for the planet. Governments also set rules that push companies to be more responsible. When companies use sustainable materials, they help protect forests and reduce pollution.

Tip: Choosing tissue products made from recycled or certified sustainable materials helps support a healthier planet.

Mother Roll Toilet Paper China: Export Dynamics

Leading Export Destinations

China sends mother roll toilet paper to many countries around the world. Australia stands out as the top destination, taking in 8,500 tons, which is about 30% of all exports. South Korea and the United States also import large amounts. India and Vietnam have become important markets, especially for bamboo pulp mother rolls. The table below shows the main export destinations and their share of total exports:

| Export Destination | Export Volume (tons) | Share of Total Exports (%) | Export Value (USD million) | Share of Total Export Value (%) |

|---|---|---|---|---|

| Australia | 8,500 | 30% | 9.7 | 26% |

| South Korea | 1,900 | 6.7% | N/A | 6.4% |

| United States | 1,500 | 5.3% | 2.4 | 6.4% |

Other countries like India and Vietnam receive regular shipments, showing how wide the reach of Mother Roll Toilet Paper China has become.

Shifts in Global Demand

Demand for mother roll toilet paper keeps changing. Some months see big jumps in exports, while others slow down. For example, exports peaked at 31,000 tons in May 2023, then dropped by 7.8% in June. Over the past year, the average monthly growth rate stayed strong at 4.8%. More countries now want higher-end tissue products, such as handkerchief and facial tissues. This shift means factories must keep up with new trends and customer needs.

Note: Even with price drops and tough competition, China’s export sector stays strong by offering new products and better quality.

Impact of Trade Policies and Tariffs

Trade policies and tariffs play a big role in export dynamics. The China National Household Paper Industry Association encourages smart investments and government support, like tax cuts, to help exporters stay competitive. Even when raw material costs rise or markets get crowded, companies keep growing by improving their products and expanding capacity. Parent rolls make up most of the export volume, showing how important they are for the industry. Despite challenges, Mother Roll Toilet Paper China continues to find new markets and adapt to global changes.

Key Market Drivers in Mother Roll Toilet Paper China

Changing Consumer Preferences

People in China want more from their toilet paper than ever before. They look for softness, strength, and even special patterns. Many now care about how products affect the environment. Families choose brands that use eco-friendly materials and safe production methods. After COVID-19, hygiene matters more, so shoppers pay attention to quality and safety. Higher incomes mean people are willing to spend extra on premium products. They also stay loyal to brands that meet their needs.

- The market grows steadily, with a CAGR of 4.60% for tissue paper converting machines in China.

- More people want products made with sustainable methods.

- Embossing and unique patterns help brands stand out.

- Hygiene awareness and disposable income drive demand for better products.

Product Innovation and Differentiation

Manufacturers in Mother Roll Toilet Paper China keep finding new ways to impress buyers. They use advanced machines to create soft, strong, and absorbent paper. Embossing adds special textures and patterns, making each roll feel unique. These patterns do more than look nice—they help people remember their favorite brands. Companies also offer different sizes and packaging to fit every family’s needs. New ideas help brands stay ahead in a busy market.

Tip: Embossed toilet paper not only feels softer but also shows a brand’s attention to detail.

Raw Material Sourcing and Cost Management

Getting the right materials at the right price is key for success. Companies look for high-quality pulp and recycled paper to keep costs low and quality high. They work with trusted suppliers and use smart buying strategies. This helps them handle price changes and keep products affordable. Good cost control means they can invest in better machines and greener materials, which keeps customers happy and loyal.

Major Challenges for the Industry

Rising Production and Logistics Costs

Production and shipping costs keep rising for tissue paper companies in China. Many factories depend on imported wood pulp, which saw record-high prices in 2022. These price jumps happened because of global supply chain problems and shipping delays. When the cost of raw materials goes up, companies have to spend more to make each roll of paper. Shipping products to other countries also costs more now, especially with fuel prices changing so often. Some companies try to manage these costs by improving their supply chains or using local materials when possible. Still, higher expenses can make it tough to keep prices low for customers.

Regulatory and Environmental Compliance

Government rules about the environment are getting stricter every year. Companies must follow new laws about pollution, waste, and how they use resources. Factories need to invest in cleaner machines and better recycling systems. These changes help protect the environment but can cost a lot of money. Many companies work hard to meet these standards because customers care about eco-friendly products. They also want to avoid fines or shutdowns. Staying up to date with regulations helps companies build trust with buyers and keep their business running smoothly.

Competitive Pressures and Market Saturation

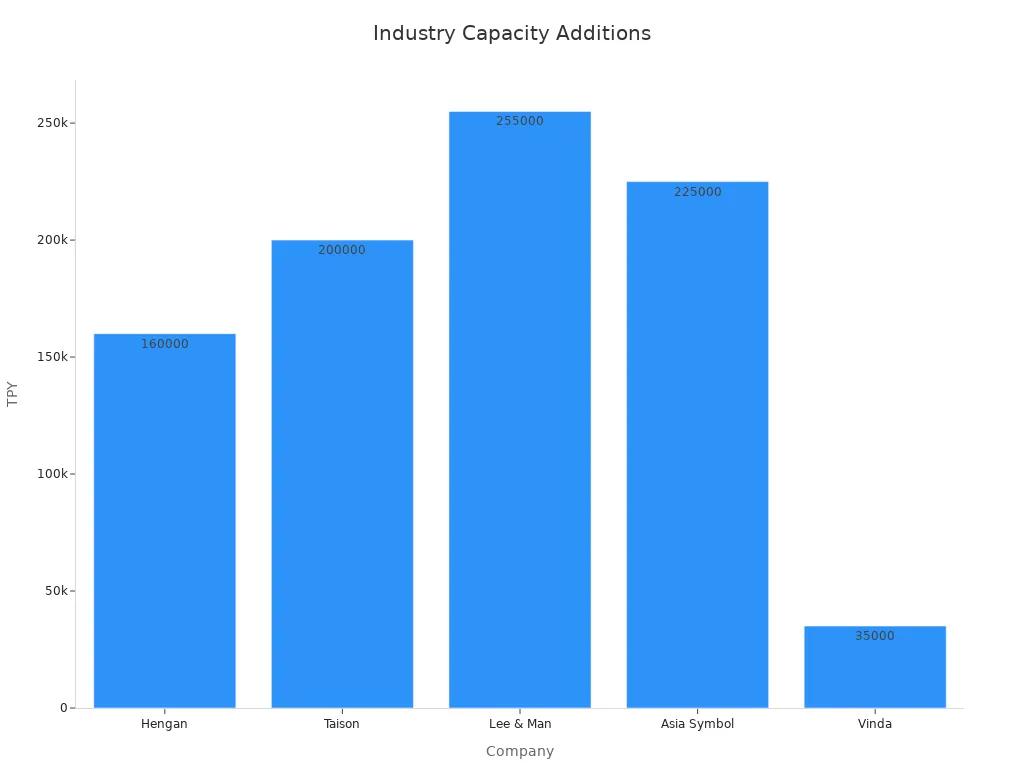

The tissue paper industry in China faces tough competition. Many companies have added new machines and increased their production. The China National Household Paper Industry Association reports that overcapacity is a big problem. Factories produce more paper than the market needs, which leads to price wars and lower profits. The table below shows how much new capacity major companies added in 2023:

| Aspect | Details |

|---|---|

| New Capacity in 2023 | Over 1.7 million tons per year (tpy) added across 35 companies and 68 machines |

| Total New Projects Announced | Approximately 3 million tpy from major companies including Hengan, Taison, Lee & Man, Asia Symbol, Vinda |

| Major Company Capacity Additions | Hengan: 160,000 tpy; Taison Group: 200,000 tpy; Lee & Man: 255,000 tpy; Asia Symbol: 225,000 tpy; Vinda: 35,000 tpy |

| Revenue Growth (Examples) | Hengan: +22.7% sales revenue (1H 2023); Vinda: +5.4% revenue (Q1-Q3 2023); C&S: +11.6% revenue (Q1-Q3 2023) |

| Profit Margin Trends | Hengan gross margin fell to ~17.7%; Vinda gross margin fell to ~25.8%; C&S net profit down 39.74% YoY |

| Market Pressure Factors | Persistent overcapacity causing intense price competition and reduced profitability |

| Raw Material Cost Pressure | Fluctuating and historically high wood pulp prices impacting margins |

| Industry Recovery Status | Post-COVID recovery with resumed production but ongoing competitive challenges |

Companies now look for ways to stand out. They focus on product innovation and better service. The industry also hopes for government support, like tax cuts or special loans, to help manage these challenges.

Emerging Opportunities in Mother Roll Toilet Paper China

New Product Categories and Value-Added Solutions

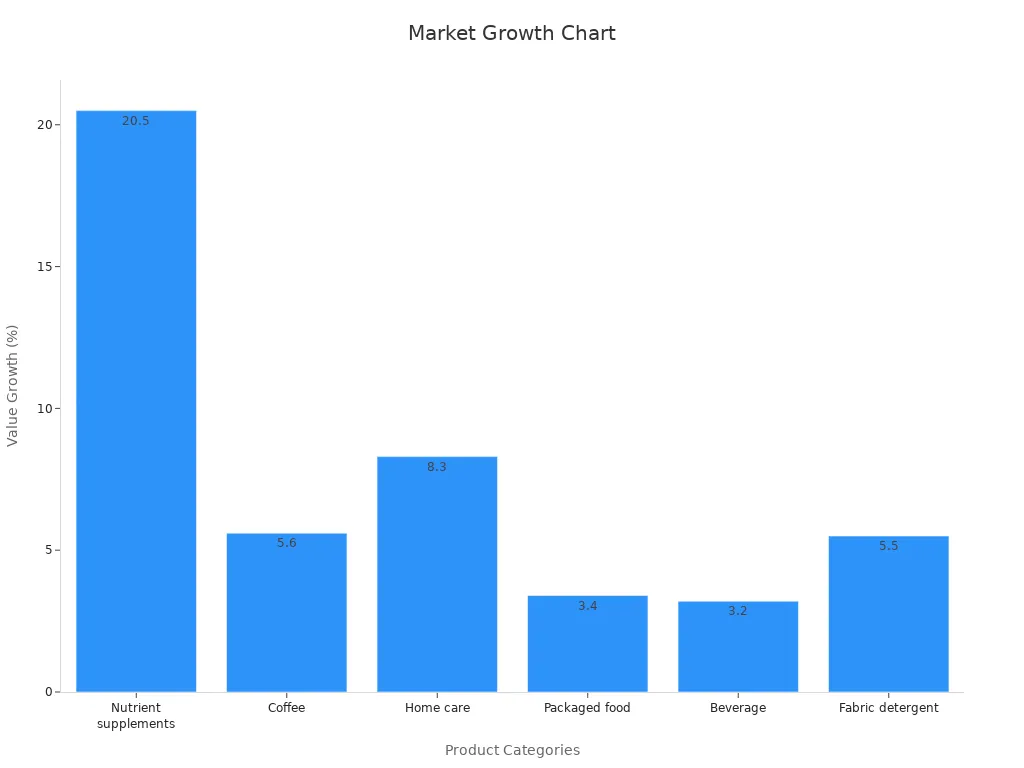

The market for tissue paper is changing fast. Companies now offer more than just basic toilet paper. They create new products that meet different needs, like baby facial tissues or face towels for special occasions. Some brands add health benefits, such as nutrient supplements, to their products. Others focus on premium items, like coffee or juice with higher quality and better taste. People want products that make life easier, so companies design things like “3 in 1” laundry pods or home care items for specific uses.

| Evidence Aspect | Details |

|---|---|

| New Product Categories | Nutrient supplements (+20.5% value growth), coffee (+5.6% value growth) |

| Value-Added Solutions | “3 in 1” laundry pods, baby facial tissue, face towels, oil remover, dishwasher detergent |

| Premiumization Trends | Juice (+9% ASP), healthier drinks, premium coffee, functional drinks (+23%) |

| Consumer Behavior | Willing to pay more for health, hygiene, and special occasions |

Expansion into Untapped Export Markets

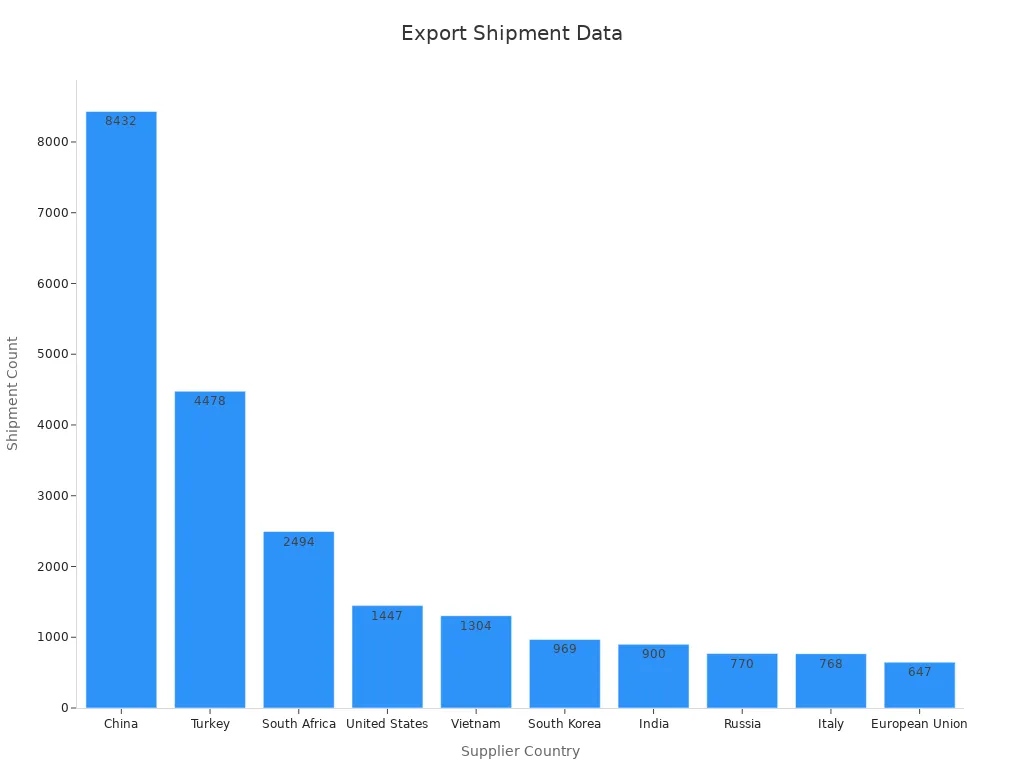

Mother Roll Toilet Paper China has a strong presence in global trade. China ships more than 75,000 export shipments and holds 25% of the world’s toilet paper export market. Major ports like Yantian and China Ports handle thousands of shipments each year. While countries like South Africa and Turkey also export a lot, many places still import smaller amounts. These countries, such as Vietnam, South Korea, India, and Russia, offer new chances for growth. Companies can use market intelligence tools to find these markets and reach more customers.

| Category | Detail | Value |

|---|---|---|

| Global Export Shipments | China’s total export shipments | 75,114 shipments |

| Global Market Share | China’s share of global toilet paper exports | 25% |

| Top Chinese Export Ports | Yantian Seaport shipments | 15,619 shipments |

| China Ports shipments | 13,134 shipments | |

| Other Leading Export Countries | South Africa shipments | 62,440 shipments |

| Turkey shipments | 52,487 shipments | |

| Supplier Country Shipment Counts | China | 8,432 shipments |

| Turkey | 4,478 shipments | |

| South Africa | 2,494 shipments | |

| United States | 1,447 shipments | |

| Vietnam | 1,304 shipments | |

| South Korea | 969 shipments | |

| India | 900 shipments | |

| Russia | 770 shipments | |

| Italy | 768 shipments | |

| European Union | 647 shipments |

Digitalization and Supply Chain Optimization

Digital tools help companies work smarter. Real-time data lets teams track shipments and inventory quickly. Predictive analytics help them guess what customers will need next, so they can manage stock better and waste less. Automation and electronic payments save time and cut costs. Digital controls keep information safe and reduce mistakes. When companies train their workers to use these tools, they stay flexible and ready for change. Sustainable practices also help save resources and lower risks.

Tip: Companies that use digital tools and smart supply chains can respond faster to market changes and keep customers happy.

Mother Roll Toilet Paper China will keep growing as companies focus on new products and smarter supply chains. Manufacturers and exporters should watch trends and invest in technology. Investors can find chances in eco-friendly solutions. Staying flexible helps everyone stay ahead in this fast-changing market.

FAQ

What is a mother roll in the toilet paper industry?

A mother roll is a large, uncut roll of tissue paper. Factories cut and process these rolls into smaller, finished products like toilet paper or napkins.

Why do companies choose China for mother roll toilet paper?

China offers strong production capacity, advanced technology, and competitive prices. Many companies trust Chinese suppliers for reliable quality and fast shipping.

How can buyers ensure product quality from Chinese suppliers?

Buyers can request samples, check certifications, and visit factories. Many suppliers, like Ningbo Tianying Paper Co., LTD., provide 24-hour support and transparent communication.

Post time: Jun-13-2025